- 75th Anniversary

75th Anniversary

What's Happening

-

75th Anniversary75th Anniversary

-

Celebration WeekCelebration Week

-

Wishes GrantedWishes Granted

-

- Personal

Personal Accounts and Lending

-

CheckingChecking

-

SavingsSavings

-

Money MarketMoney Market

-

CertificatesCertificates

-

High Yield HolidayHigh Yield Holiday

-

High Yield Summer SavingsHigh Yield Summer Savings

-

Round Up RewardsNewRound Up Rewards

-

Auto LoansAuto Loans

-

Credit CardsCredit Cards

-

Home LoansHome Loans

-

Personal LoansPersonal Loans

-

Recreational LoansRecreational Loans

-

- Business

-

Business CheckingBusiness Checking

-

Business SavingsBusiness Savings

-

Business CertificatesBusiness Certificates

-

Business Term LoansBusiness Term Loans

-

Commercial Real EstateCommercial Real Estate

-

Corporate Credit CardCorporate Credit Card

-

Business Line of CreditBusiness Line of Credit

-

Business Vehicle LoansBusiness Vehicle Loans

-

Business Equipment LoansBusiness Equipment Loans

Services

-

ONE in the WorkplaceONE in the Workplace

-

CAREs ProgramNewCAREs Program

-

Lunch and LearnLunch and Learn

-

- Youth

Youth Accounts

-

Youth AccountsYouth Accounts

-

Graduation Growth FundGraduation Growth Fund

-

A's for $$$A's for $$$

-

Comic BooksComic Books

-

PuzzlesPuzzles

-

TV ShowsTV Shows

-

- Financial Wellness

Financial Wellness

Financial Wellness @ ONE

-

Financial LiteracyFinancial Literacy

-

Credit & Debt CoachingCredit & Debt Coaching

-

Fraud & ID TheftFraud & ID Theft

Financial Tools

-

Financial CalculatorsFinancial Calculators

-

Free Budget FormsFree Budget Forms

-

Credit CheckComing Soon

-

ArticlesComing Soon

-

- Digital Banking

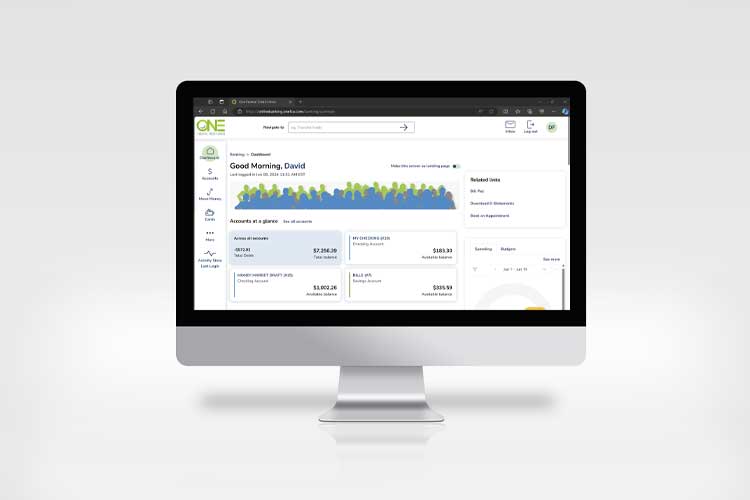

Digital Banking

Manage Accounts

-

Digital ServicesDigital Services

-

Mobile BankingMobile Banking

-

Money DesktopMoney Desktop

-

Bill PayBill Pay

-

Digital WalletNewDigital Wallet

More for Members

-

Pay LoanPay Loan

-

Ezcard InfoEzcard Info

-

Personal InsurancePersonal Insurance

-

- In the Community

Community Involvment

Community Involvement

-

Impact ReportImpact Report

-

Milestone MagazineMilestone Magazine

-

Monthly Update

-

Request a DonationRequest a Donation

-

- Contact

Contact Us

Get in Touch

-

Become a MemberBecome a Member

-

Book an AppointmentBook an Appointment

-

Apply OnlineApply Online

-

Hours of OperationHours of Operation

-

Phone NumbersPhone Numbers

-

Holiday ClosingsHoliday Closings

-

FAQ'sFAQ's

Locations

-

Find a BranchFind a Branch

-

Find an ATMFind an ATM

-

- About

- 75th Anniversary

75th Anniversary

What's Happening

-

75th Anniversary75th Anniversary

-

Celebration WeekCelebration Week

-

Wishes GrantedWishes Granted

-

- Personal

Personal Accounts and Lending

-

CheckingChecking

-

SavingsSavings

-

Money MarketMoney Market

-

CertificatesCertificates

-

High Yield HolidayHigh Yield Holiday

-

High Yield Summer SavingsHigh Yield Summer Savings

-

Round Up RewardsNewRound Up Rewards

-

Auto LoansAuto Loans

-

Credit CardsCredit Cards

-

Home LoansHome Loans

-

Personal LoansPersonal Loans

-

Recreational LoansRecreational Loans

-

- Business

-

Business CheckingBusiness Checking

-

Business SavingsBusiness Savings

-

Business CertificatesBusiness Certificates

-

Business Term LoansBusiness Term Loans

-

Commercial Real EstateCommercial Real Estate

-

Corporate Credit CardCorporate Credit Card

-

Business Line of CreditBusiness Line of Credit

-

Business Vehicle LoansBusiness Vehicle Loans

-

Business Equipment LoansBusiness Equipment Loans

Services

-

ONE in the WorkplaceONE in the Workplace

-

CAREs ProgramNewCAREs Program

-

Lunch and LearnLunch and Learn

-

- Youth

Youth Accounts

-

Youth AccountsYouth Accounts

-

Graduation Growth FundGraduation Growth Fund

-

A's for $$$A's for $$$

-

Comic BooksComic Books

-

PuzzlesPuzzles

-

TV ShowsTV Shows

-

- Financial Wellness

Financial Wellness

Financial Wellness @ ONE

-

Financial LiteracyFinancial Literacy

-

Credit & Debt CoachingCredit & Debt Coaching

-

Fraud & ID TheftFraud & ID Theft

Financial Tools

-

Financial CalculatorsFinancial Calculators

-

Free Budget FormsFree Budget Forms

-

Credit CheckComing Soon

-

ArticlesComing Soon

-

- Digital Banking

Digital Banking

Manage Accounts

-

Digital ServicesDigital Services

-

Mobile BankingMobile Banking

-

Money DesktopMoney Desktop

-

Bill PayBill Pay

-

Digital WalletNewDigital Wallet

More for Members

-

Pay LoanPay Loan

-

Ezcard InfoEzcard Info

-

Personal InsurancePersonal Insurance

-

- In the Community

Community Involvment

Community Involvement

-

Impact ReportImpact Report

-

Milestone MagazineMilestone Magazine

-

Monthly Update

-

Request a DonationRequest a Donation

-

- Contact

Contact Us

Get in Touch

-

Become a MemberBecome a Member

-

Book an AppointmentBook an Appointment

-

Apply OnlineApply Online

-

Hours of OperationHours of Operation

-

Phone NumbersPhone Numbers

-

Holiday ClosingsHoliday Closings

-

FAQ'sFAQ's

Locations

-

Find a BranchFind a Branch

-

Find an ATMFind an ATM

-

- About